The FTX Platform Scandal:

A Story of Schemes and Betrayal

Ah, crypto… A fascinating universe where everything seems possible, from the dream of getting rich doing nothing to

ruin

faster than the intern disappearing on Friday at 5:59 PM. And if there's one story that perfectly illustrates this

emotional rollercoaster, it's FTX. A platform worth billions, investors who thought they were

untouchable, and in the end… a monumental crash, vanished funds, and a boss who went from crypto genius to Sith Lord

of

fraud.

Who are the actors behind this fiasco, and how did justice react to this financial catastrophe? This

article traces the key events of the FTX scandal, one of the biggest scams in

cryptocurrency history.

FTX's Meteoric Rise

In 2019, a certain Sam Bankman-Fried, aka SBF (aka Palpatine), shows up with a brilliant

idea: create a crypto

exchange platform faster, more reliable, and more innovative than all the others. And it works!

In less than three years, FTX became one of the largest cryptocurrency exchange platforms in the

world, with a valuation reaching $32 billion in 2021. The company quickly

attracted institutional investors, celebrities, and renowned athletes like Tom Brady and Gisele Bündchen,

who became brand ambassadors. The media and financial support made FTX a key player in the crypto market.

From Hype to Free Fall Without a Parachute

The First Warning Signs (that we all ignored)

On November 2, 2022, CoinDesk drops a bomb: FTX's sister company, Alameda Research, is actually stuffed with

FTT tokens (the crypto issued by FTX). In other words, the house of cards rests on its own shaky

foundations. Not ideal for reassuring investors...

Then comes the plot twist: Binance, the industry giant and main competitor, announces it wants to liquidate all its

FTT.

I know it's weird. Why would a direct rival have bought FTT tokens in the first place? Apparently, in the

crypto world, it's common practice: everyone buys from everyone. Business is business!

Result: total panic. Investors flee, withdrawals explode… and FTX finds itself

dry. Exactly like a failing bank: As long as no one withdraws en masse, the illusion holds. But at the slightest

doubt, everything collapses in a few days. First come, first served get their money back, the others are left crying.

The Real-Time Catastrophe

On November 8, 2022, FTX blocks withdrawals. The platform simply doesn't have enough cash to cover

user demands. Within days, it files for bankruptcy. Result: $8 billion evaporated. Yes,

eight billion. Let's just say the Monday morning vibe at work wasn't great.

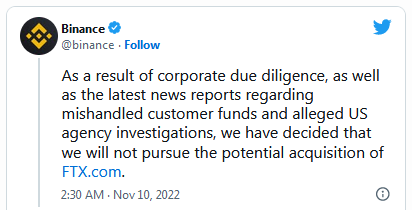

At first, Binance seems to play the savior by announcing its intention to acquire FTX

to pull it from the wreckage. A short-lived hope. After taking a look at the company's finances, the verdict

comes down: it's a real bottomless pit. Too much debt, too many risks, too many skeletons... In less than 24 hours,

Binance backs out and tweets a message that basically says "FTX is the Titanic but not the one that's sinking, the one

that's already been at the bottom of the ocean for a century".

The Investigation and Accusations

Where Did All That Money Go?

US authorities immediately opened an investigation into FTX and its executives. Sam

Bankman-Fried and his associates found themselves under fire with accusations: fraud, market manipulation and

misappropriation of funds. The investigation revealed that the platform was using client money as a source of

funding for highly speculative investments, notably through Alameda Research. Result? An abysmal

financial hole.

In short, SBF and his team managed client funds like a child in a candy store with their parents' credit card:

without limits and without thinking about the consequences.

Result: about a million users see their savings disappear. And when they ask for

explanations, FTX responds… nothing, since the company is bankrupt. Nothing except a "What happened" from SBF

on Twitter like some kind of puzzle...

Legal Troubles

Obviously, US justice doesn't take long to get involved. On December 12, 2022, Sam Bankman-Fried is arrested and charged with fraud, money laundering and other financial goodies. His image as a little philanthropic genius? Dismantled faster than IKEA furniture without instructions.

The Trial and Sentences

Bankman-Fried's trial began in 2023 and he faces several decades in prison. The details of the trial were closely followed by the media and financial analysts, as it became a symbol of the irresponsibility and greed that led to the collapse of one of the largest cryptocurrency platforms. In addition to him, several other FTX executives, including former chief engineer Gary Wang, and former chief operating officer Caroline Ellison, were charged.

Conclusion: FTX, a Crash That Leaves Scars

If this story teaches us anything, it's that even companies that seem unshakeable can

collapse overnight. A bubble always ends up bursting.

So, next time a crypto project promises you the moon, remember FTX. And

ask yourself the only question that matters: isn't this just another pyramid waiting its turn to

collapse?

Answer in the next episode of the great crypto soap opera. 🍿

"Sometimes life creeps up on you."

Share or you're a noob!

Our Crypto Affiliations

Want to buy your first cryptos?

Discover our complete guide then click on our official links for each platform and start easily!

Keywords Cloud

Navigation

Warning

"The content published on Cryptosac www.cryptosac.fr is for informational purposes only and does not constitute investment advice or financial recommendation."

Key Dates:

-

Launch of the FTX platform by Sam Bankman-Fried and Gary Wang.

-

FTX raises $900 million, reaching a valuation of $18 billion.

-

CoinDesk publishes an article revealing that the majority of Alameda Research's assets are FTT tokens, raising concerns about FTX's solvency.

-

Binance announces the liquidation of its FTT, triggering panic and massive fund withdrawals from FTX.

-

Binance signs a letter of intent to acquire FTX, but backs out the next day after reviewing the company's finances.

-

FTX, FTX US and Alameda Research file for bankruptcy. Sam Bankman-Fried resigns as CEO.

-

Sam Bankman-Fried is arrested in the Bahamas at the request of US authorities.

-

Sam Bankman-Fried pleads not guilty to charges of fraud and money laundering.